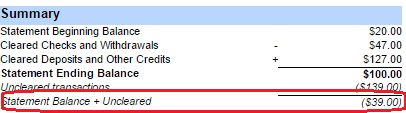

To make sure your bank balances to the GL, you should verify that the “Statement Balance + Uncleared” value on the reconciliation report (circled in red in image below) and the GL account balance for that bank account as of the same date match. There are a few reasons these values may not match. When you approve a bank rec it takes a snapshot of the system as of that time so the “Statement Balance + Uncleared” value on the reconciliation report is showing the balance according to that snapshot.

Reasons You Might Not Balance

Example 1 “Entered a transaction after completing the bank rec”: Let’s assume you’ve doing a bank rec with a statement end date of 10/31 and you approve it on 11/8. Then on 11/15 you enter a new bank withdrawal transaction and date it 10/28. If you run a report to see the GL account balance of your bank account (such as Trial Balance, Balance Sheet, GL Account Detail reports) as of 10/31 then this 10/28 transaction will be reflected in that balance. However, the reconciliation report is based off the snapshot of the time when the bank rec was approved so this transaction will not be included in the balance of that bank rec so there will be a discrepancy. If you don’t want the discrepancy to show up, you will need to unapprove the bank rec which will then pick up this new transaction and then approve the bank rec again. This transaction will now show in the uncleared list on that bank rec and will be part of that balance on the reconciliation report.

Example 2 “User entered wrong statement beginning balance on a bank rec”: The beginning balance on a bank rec defaults as the ending balance from the previous bank rec but the user can override this value if desired. If the user puts the wrong value in this field then the math on this bank rec won’t balance with the previous rec which might cause it to be out of balance with the GL account.

Example 3 “Started with incorrect beginning balance went went live with system”: Let’s assume you started using the system and put a beginning balance for the GL account of this bank account of $100 in your beginning balance journal entry. Then you set the Last Reconciled Balance for that bank account as $150. If the last reconciled balance was $150 according to your bank and the actual balance in the account was $100 according to your prior financial system, then that means there are $50 of expenses in your prior system that need to be entered as Open Bank Transactions (unreconciled transactions) to start in this system. If you didn’t enter those $50 of expenses as bank beginning balance transactions or entered an amount other than $50, then you will be out of balance because to start the system your GL was already out of balance from the bank.

There are various other reasons they might differ such as making an edit to a transaction after reconciliation or voiding a reconciled transaction.

Bank to GL Reconciliation Report Will Help

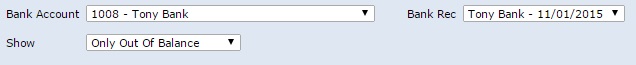

To help you investigate the reasons for the difference you can run the report titled “Bank to GL Reconciliation” in the Banking section of the My Reports page. For this report you can select the bank account you want to evaluate, the bank rec you want to evaluate it as of, and choose whether to show Only Out of Balance Reconciliations, All Reconciliations. or This Reconciliation Only. Because of the huge amount of data this report is analyzing to find possible balance problems, it may take some time to run.

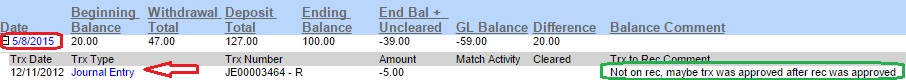

Once you’ve selected your parameters and run the report, it will display a row for each reconciliation with a + sign on the far left (circled in red in image below). Clicking the + sign will show all details for the reconciliation. Clicking the blue date on the reconciliation row (circled in red in image below) will open that bank rec. In the far right column of each detail row that might be causing a balance issue, there will be a comment (circled in green in image below). The comment will be a description of why that row might be causing an issue such as “Not on rec, maybe trx was approved after rec was approved” as explained in Example 1 above. You can also open the transaction on a detail row by clicking the blue transaction type link (red arrow in image below).

Review this report to help you narrow down your issues and resolve them.